Sustainable Investments

The regulation of sustainable finances continues to evolve at a dizzying pace and the years to come continue with the trend.

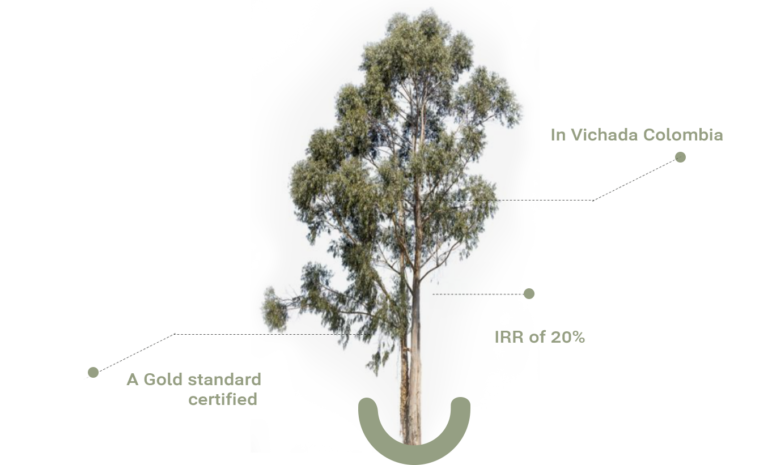

An alternative investment that reimagines the role of

trees in the voluntary carbon market.

Colombian Carbon Credits offers a unique 30-year investment opportunity with a projected annualized return of 20%+ through the generation of carbon offsets from Eucalyptus Pelita trees, aligning with global climate goals and sustainable development, and partnering with top forestry management to provide high-quality, low-risk investments.

Portfolio diversification: The VCM is experiencing significant growth due to rising awareness of climate issues along with increasing demand for carbon offsets. The growth of the VCM presents potential financial returns for investors as the market matures and carbon credit prices rise.

Sustainability: Investing in the VCM allows businesses and individuals to support projects that reduce greenhouse gas emissions. Moreover, proactive investment in carbon offsets can help companies hedge against potential future costs associated with carbon emissions and align with anticipated policy changes aimed at achieving global climate targets.

Passive income: Once a carbon credits project is established and operational, it generates carbon credits based on the emissions it reduces or offsets, which can be sold in the voluntary carbon market for relatively passive income, as the main work is in the initial setup and maintenance while revenue continues over time.

Regulation hedging: As governments worldwide implement stricter carbon regulations and potential carbon pricing mechanisms, companies with established practices in carbon offsetting will be better equipped to comply with new regulations.

Inflation-hedging: Land is an asset that is inflation hedging, which represents an attractive investment to create a diversified portfolio. Additionally, investing in the VCM can serve as a strategic move to mitigate future regulatory risk.

Growth: Early investment in high-quality carbon offset projects can yield substantial returns as the market expands and regulatory frameworks potentially increase the demand for verified carbon offsets.

José Ignacio Soto

CEO

Felipe Gutiérrez

Wealth Management Director

Juan Darío Gutiérrez

Chief Legal Officer

Daniel Gutiérrez

Chieff Operations Manager

Natalia Quevedo

Chief Executive Officer

Alejandro Ceballos

Chief Financial Officer

Gabriel Lopera

Chief Operating Officer

The regulation of sustainable finances continues to evolve at a dizzying pace and the years to come continue with the trend.

Dear Colombian Timber Investors, What better way to end the year than with the best possible news we could ever give: that our project is

After two weeks of negotiations, the UN climate summit in Glassgow, COP26, came to an end.

We finished the operation of our nursery with great safisfaction: we met the goals set for this year and the establishment schedule.

The UN officially launched a 10-year pan to restore damaged ecosystems.

Our 2021 Establishment Operational Plan is currently in the land preparation and planting phase.

Request more information about this investment opportunity by reaching out to us:

contact@gutierrezgroup.com.co

+57 (4) 322 88 98

Edificio Forum.

Cl. 7 Sur #42 - 70,

El Poblado, Medellín, Antioquia

Subscribe to our newsletter and stay informed of all the news of the sector.